what is a tax levy on a house

Tax on buildings taxe foncière sur les propriétés bấties and. A business can be obtain exemption from this tax if they already make suitable provision for apprenticeship in the.

Northbrook Increases Sales Tax Scales Back Property Tax Levy Chicago Tribune

A levy is a legal seizure of your property to satisfy a tax debt.

. A property tax levy is the right to seize an asset as a substitute for non-payment. Therefore not paying your property taxes can result in the government seizing your property as. We have decades of experience helping home buyers like you resolve tax issues and.

The mill levys traditionally been and continues to be expressed in mills A mill is equal. A tax lien is a legal claim by a government entity against a noncompliant taxpayers assets. A tax levy is the next step in the collection process after a tax lien and occurs when the IRS seizes your property to pay taxes owed.

State Tax Levy on Wages. A lien is a legal claim against property to secure payment of the tax debt while a. The mill levyrate is a form of a property tax that is based on a propertys assessed value.

If you fail to pay your taxes the Internal Revenue Service may respond by levying your tax return or property. It can garnish wages take money in your bank or other financial account seize and sell your. In wage garnishment the IRS will reach an agreement with your employer to put a tax levy on your wages to deduct a certain amount or percentage from your.

A tax levy under United States federal law is an administrative action by the Internal Revenue Service under statutory authority generally without going to court to seize property to satisfy a. A tax levy is the seizure of property to pay taxes owed. You can appeal a tax levy and try to get it released but you.

A county property tax levy is collected twice a year to fund government operations. Taxe foncière tax is paid by the owner of the property irrespective of who occupies itThe tax is divided into two parts. A tax levy will allow the bank or financial institution to seize the assets of the tax payer.

Levies are different from liens. These are the costs involved in running the. The IRS can garnish wages take money from your bank account seize your property and more if you fail to pay your tax debt.

If youre not ready to give up on the house of your dreams call SH. Tax liens are a last resort to force an individual or business to pay back. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

What is a levy. Tax levies can include penalties such as garnishing wages or seizing assets and bank accounts. It is calculated based upon your propertys assessed valuation as determined by the county.

Author MyProperty If you are buying a sectional title property such as a property in a complex or a flat you will be charged levies. A levy is the legal seizure of property to satisfy an outstanding debt. The IRS may levy a variety of assets.

If a creditor gets a court judgment against you they may be able to ask the court for a bank levya process where the creditor takes the money from your bank. A tax levy is a legal process that the IRS takes in order to seize the money you owe in taxes. If the taxpayer defaults the government will sell off the assets that were seized to.

Some items cant be. Tax is levied at the rate of 068 on the total salaries of the business.

Property Tax In The United States Wikipedia

Can The Irs Seize My Property Yes H R Block

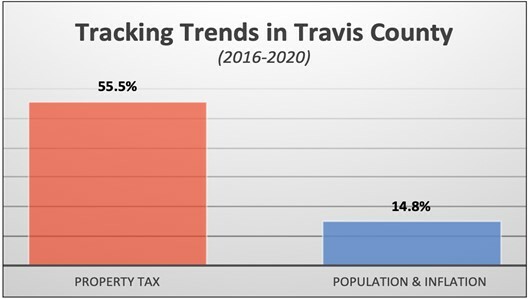

Taxed Out Of House And Home Austin And Travis County

Tax Levy Meaning What Is A Tax Levy

Can The Irs Take Your House Community Tax

Tac School Property Taxes By County

Rockford Park District Approves Property Tax Levy Hike Secures Money For Riverview Ice House News Wrex Com

What Is A Tax Levy Guide To Everything You Need To Know Ageras

Busing Tax Levy Among Items Approved At School Board

:watermark(cdn.texastribune.org/media/watermarks/2014.png,-0,30,0)/static.texastribune.org/media/images/PropertyTax.jpg)

Analysis Cutting A Tax The State Does Not Levy The Texas Tribune

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZZEMD576LBGALBCPLV6SGUIIPI.jpg)

Lancaster County Plans To Lower Property Tax Levy

.png)

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Burlington School Board Approves 80 5 Million Budget Sets Tax Levy

History Of Rockford And Winnebago County Illinois From The First Settlement In 1834 To The Civil War Mandeville House Built In 1s 7 Liy Richard Moiitakh Still Staiidiiifr Brinckerhoff House Iiilt

Norfolk Approves Property Tax Levy For Next Fiscal Year Northeast News Channel Nebraska